Mike Adapts to a Health Condition

- Meet Mike

- Mike Learns About His Disability

- Mike Adapts to His Disability

- Mike’s Income Goes Up

- How Mike Did It

- Next Steps

Try It

Mike Adapts to a Health Condition

Mike Adapts to His Disability

Mike thought about what the doctor had said and about his own feelings. He contacted a local support group for people with MS and learned about how they had adjusted in similar situations. As he thought about things more and more, he decided he wanted to leave his job and just do some freelance writing for a while. With the changes he was going to be making in his life, he didn’t want to be tied down to a job running around from high school to high school to watch teenagers playing hockey.

Mike called up the Human Resources person at his job, Kelly, and told her that he was going to leave. He knew that he could request reasonable accommodations to continue his work there, but after thinking long and hard about things, he knew that freelancing was the best for him for the time being. This was a major decision and he was afraid, because his job was how he got health insurance and he knew that freelance writing wouldn’t cover all of his medical bills. That’s one of the things he wanted to talk about with Kelly.

Mike asked, “Is there any way for me to stay on the company health plan, even though I won’t be working at the paper anymore?”

Kelly immediately replied, “Yes, you can stay on our plan, thanks to a federal law called COBRA. However, you’d have to pay the full monthly premium for it; we can’t pay the premium for ex-employees. You’ll get COBRA paperwork in the mail a few weeks after you stop working here.”

The next week, when Mike met with his multiple sclerosis support group, he mentioned the health insurance issue and asked what they did.

A member of the group named Jim spoke up, “That’s a good question, Mike. There’s been a lot of changes related to health insurance over the last few years and the situation is a lot better for people with disabilities than it used to be. When I left my job 2 years ago, I had to do COBRA, because otherwise I would’ve been denied insurance due to my pre-existing conditions caused by MS. But starting in 2014, private health insurers can’t deny you coverage or raise your premiums just because you’ve got a pre-existing condition. And, if you don’t make much money, either the government will help pay part of your monthly premium or you’ll qualify for government health coverage, like Medical Assistance (MA) or MinnesotaCare.”

Mike hoped that one of these options would work for him, since he didn’t know how well he’d do with his freelance work. He asked Jim where there might be more information about this.

“Check out DB101.org,” said Jim. “It’s got a lot of articles about this stuff and a pretty neat little guide to health care that lets you punch in how much money you make and see what health coverage might be right for you. It’s a great way to get an initial grasp of what might work for you.”

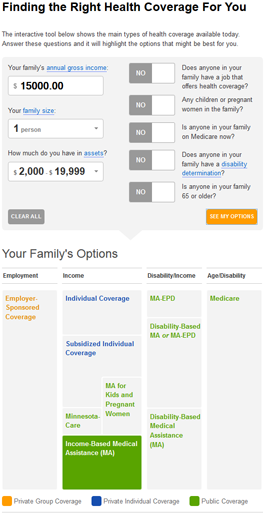

Mike thanked Jim and checked out DB101. When he saw the Finding the Right Health Coverage for You interactive guide, he estimated that he’d make about $15,000 his first year as a freelance writer. He also put in that he lived alone and his assets level, which was more than $2,000, but less than $20,000. One of the questions asked if he had a disability determination. He didn’t yet, so he said no. When he had finished filling everything out, DB101 recommended that he look into “Income-Based Medical Assistance (MA).” Apparently, he’d probably qualify for free MA coverage!

Looking at DB101, he saw there was something called Chat with a Hub expert. He decided to call up the phone number (1-866-333-2466) and get some live help from somebody who worked in the field. He spoke with Andy, who confirmed what DB101 said: Mike would qualify for MA.

Mike asked, “Can you explain that question about the disability determination? Does MS count?”

“Those are good questions,” replied Andy. “There’s more than one way to qualify for MA if your disability meets certain standards. You answered the question correctly, since you do not have a disability determination, even though you have a disability. For adults, one of the requirements to be considered disabled by MA is that you be unable to earn much money. Since you are still able to work, you wouldn’t be considered disabled for the purposes of MA or most other disability-based benefits. If you like, you can read an explanation of the disability determination process on DB101. It is possible that if your disability gets worse at a later date and prevents you from working much, you could be determined disabled and start getting disability-based benefits like Social Security Disability Insurance (SSDI).”

Andy paused to see if Mike had any questions, then continued, “The good news for you is that MA covers many adults who are not determined disabled, including almost anybody whose family income is below 138% of the Federal Poverty Guidelines (FPG). And $15,000 a year is below the income limit for a one-person household, like yours, which is why you qualify. So, even though you do not have an official disability determination, you’ll qualify for free medical coverage that will be a big help with your disability-related medical needs.”

Health Coverage Income Limits for Your Family

| Your family size: | |

Income limits for your family: | |

| $15,650 | |

| $5,500 | |

| $15,650 | |

| $5,500 | |

| 400 | |

| $15,650 | |

| $5,500 | |

| Income-based MA, adults (138% FPG) | |

| Income-based MA, children/pregnant women (280% FPG) | |

| MinnesotaCare (200% FPG) | |

| Subsidized private plans, reduced fees (250% FPG) | |

| Subsidized private plans (400% FPG) | |

If your family's income is at or below the limit for a program, you may qualify if you meet other program rules.

Notes:

| |

“Thanks for the information. How can I sign up?” asked Mike.

“Just go to MNsure,” said Andy. “It’s easy to apply there and you’ll get an immediate answer as to whether you qualify. Remember that if your income goes up in the future, you need to update your info on MNsure, so that you can keep getting the right type of health coverage for your situation.”

Mike went ahead and completed an application on MNsure and just as Andy had said, he was approved for MA. Mike was very happy that he’d be getting free health coverage and could focus his mental energies on establishing himself as a freelance writer instead of worrying about how to pay his medical bills.

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Give Feedback