Mike Adapts to a Health Condition

Try It

Meet Mike

At the age of 45, Mike learns that he has the early signs of multiple sclerosis (MS). He decides to contact an MS support group to get advice on how having a disability might impact his life. There he gets ideas about how he can adjust his work and learns about health coverage options. He decides to leave his job as a writer at a newspaper and become a freelance writer, so that he can control his schedule better as he adapts to his disability. When he leaves his job, he signs up for Medical Assistance (MA), because he no longer has employer-sponsored health coverage.

By the time he’s been working on his own for a few years, his work income has gone up, he’s started to put some money away for retirement, and he’s happy to know that he’s accumulating Social Security work credits so that if his disability gets worse and he needs Social Security Disability Insurance (SSDI), he’ll get it.

| Meet Mike | |

| Before disability: | |

| Name: | Mike |

| Age: | 42 |

| Disability: | None he knows of |

| Occupation: | Journalist at a newspaper |

| Income: | $3,500 per month ($42,000 annually) |

| Resources: | $4,000 in a savings account |

| Health coverage: | Employer sponsored |

| Adjusting to future disability: | |

| Age: | 45 |

| Disability: | Brain lesions indicating multiple sclerosis (MS) |

| Occupation: | Freelance writer |

| Income: | $1,250 per month ($15,000 annually) |

| Resources: | $2,000 in a savings account |

| Health coverage: | Medical Assistance (MA) |

| Thinking about the long term: | |

| Age: | 48 |

| Disability: | Brain lesions indicating multiple sclerosis (MS) |

| Occupation: | Freelance writer |

| Income: | $3,000 per month ($36,000 per year) |

| Resources: | $4,000 in an IRA; $4,000 in savings |

| Health coverage: | Individual coverage purchased on MNsure |

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Mike Adapts to a Health Condition

- Meet Mike

- Mike Learns About His Disability

- Mike Adapts to His Disability

- Mike’s Income Goes Up

- How Mike Did It

- Next Steps

Try It

Mike Learns About His Disability

At age 42, Mike was a sports reporter at a local newspaper. He had always dreamed of covering the Twins, but his job wasn’t that glamorous — he worked at a community newspaper, the kind of paper that ran pictures of lost pets. He made about $42,000 per year, which wasn’t a lot, but he wasn’t married and had no kids, so it paid the bills.

One of the perks of his job was that he had employer-sponsored health coverage, but last year during open enrollment, Mike noticed that the health insurance options had changed some and the out-of-pocket expenses for employees were higher than they used to be. He talked to the paper’s Human Resources manager, Kelly, and asked her why things had changed.

Kelly replied, “Mike, the options we are able to offer each year can change, depending on how much insurers want to charge. Since our newspaper is in tough financial shape, we can’t contribute more to the monthly premium. We’ve tried really hard to offer a set of insurance options for employees to choose from, depending on their situations. Look over this information about the plans offered through our company to see which makes the most sense for you financially. You may also want to check in with your doctors to see what insurance they take.”

Kelly motioned at the paperwork, “Some of these plans are cheaper than others, but not all doctors are on any given plan. Also, their copayments and deductibles vary, so depending on how often you go to the doctor, you may want to choose one plan or another. You’ll have to decide what is important to you and balance some things.”

Mike followed Kelly’s advice. Open enrollment lasted for a couple of weeks, so he took his time to compare the 3 plans his job offered. He noticed that the Health Maintenance Organization (HMO) plan his job offered was the cheapest and that sounded good to him. Then he checked with his doctor at the time, whom he liked and trusted. The doctor’s office threw him a curveball — the doctor didn’t take HMO customers. The only coverage offered by Mike’s employer that his doctor accepted was the Preferred Provider Organization (PPO) plan.

Mike decided he wanted the cheaper plan, so he went ahead and signed up for the HMO. Even though he’d have to find new doctors, he wasn’t too worried, because he didn’t go to the doctor often and didn’t care that much if he had to change doctors. Over the following months, his work went well enough — he covered whatever his editors told him to write about, be that field hockey, lacrosse, or high school football. It wasn’t exactly his dream job, but it was an honest living. And, if he kept it up, maybe someday he’d be able to get a job at a big city paper.

Then, Mike began feeling a weird, persistent numbness on his left side. At first, he thought it was just the aches and pains of aging, but after a couple of weeks, he realized it was something more and that it was getting worse, so he went to his new doctor. The doctor didn’t have good news for Mike: tests showed that he had brain lesions, an early indicator of multiple sclerosis (MS). MS is a gradually debilitating neurological disorder that causes people to shake and lose mobility.

The doctor did offer Mike hope. He didn’t think Mike’s condition would be so bad that the writer would need to completely stop working, but he did think that Mike would have to make some changes in his life. In addition to beginning physical therapy, the doctor also suggested that Mike get in touch with a support group that could help him adjust to his new status as a person with a disability.

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Mike Adapts to a Health Condition

- Meet Mike

- Mike Learns About His Disability

- Mike Adapts to His Disability

- Mike’s Income Goes Up

- How Mike Did It

- Next Steps

Try It

Mike Adapts to His Disability

Mike thought about what the doctor had said and about his own feelings. He contacted a local support group for people with MS and learned about how they had adjusted in similar situations. As he thought about things more and more, he decided he wanted to leave his job and just do some freelance writing for a while. With the changes he was going to be making in his life, he didn’t want to be tied down to a job running around from high school to high school to watch teenagers playing hockey.

Mike called up the Human Resources person at his job, Kelly, and told her that he was going to leave. He knew that he could request reasonable accommodations to continue his work there, but after thinking long and hard about things, he knew that freelancing was the best for him for the time being. This was a major decision and he was afraid, because his job was how he got health insurance and he knew that freelance writing wouldn’t cover all of his medical bills. That’s one of the things he wanted to talk about with Kelly.

Mike asked, “Is there any way for me to stay on the company health plan, even though I won’t be working at the paper anymore?”

Kelly immediately replied, “Yes, you can stay on our plan, thanks to a federal law called COBRA. However, you’d have to pay the full monthly premium for it; we can’t pay the premium for ex-employees. You’ll get COBRA paperwork in the mail a few weeks after you stop working here.”

The next week, when Mike met with his multiple sclerosis support group, he mentioned the health insurance issue and asked what they did.

A member of the group named Jim spoke up, “That’s a good question, Mike. There’s been a lot of changes related to health insurance over the last few years and the situation is a lot better for people with disabilities than it used to be. When I left my job 2 years ago, I had to do COBRA, because otherwise I would’ve been denied insurance due to my pre-existing conditions caused by MS. But starting in 2014, private health insurers can’t deny you coverage or raise your premiums just because you’ve got a pre-existing condition. And, if you don’t make much money, either the government will help pay part of your monthly premium or you’ll qualify for government health coverage, like Medical Assistance (MA) or MinnesotaCare.”

Mike hoped that one of these options would work for him, since he didn’t know how well he’d do with his freelance work. He asked Jim where there might be more information about this.

“Check out DB101.org,” said Jim. “It’s got a lot of articles about this stuff and a pretty neat little guide to health care that lets you punch in how much money you make and see what health coverage might be right for you. It’s a great way to get an initial grasp of what might work for you.”

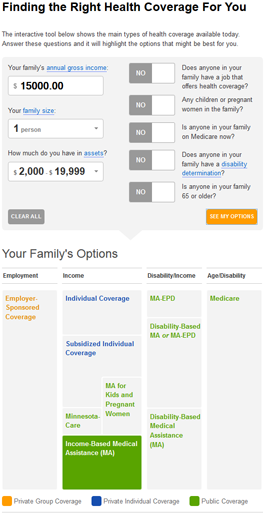

Mike thanked Jim and checked out DB101. When he saw the Finding the Right Health Coverage for You interactive guide, he estimated that he’d make about $15,000 his first year as a freelance writer. He also put in that he lived alone and his assets level, which was more than $2,000, but less than $20,000. One of the questions asked if he had a disability determination. He didn’t yet, so he said no. When he had finished filling everything out, DB101 recommended that he look into “Income-Based Medical Assistance (MA).” Apparently, he’d probably qualify for free MA coverage!

Looking at DB101, he saw there was something called Chat with a Hub expert. He decided to call up the phone number (1-866-333-2466) and get some live help from somebody who worked in the field. He spoke with Andy, who confirmed what DB101 said: Mike would qualify for MA.

Mike asked, “Can you explain that question about the disability determination? Does MS count?”

“Those are good questions,” replied Andy. “There’s more than one way to qualify for MA if your disability meets certain standards. You answered the question correctly, since you do not have a disability determination, even though you have a disability. For adults, one of the requirements to be considered disabled by MA is that you be unable to earn much money. Since you are still able to work, you wouldn’t be considered disabled for the purposes of MA or most other disability-based benefits. If you like, you can read an explanation of the disability determination process on DB101. It is possible that if your disability gets worse at a later date and prevents you from working much, you could be determined disabled and start getting disability-based benefits like Social Security Disability Insurance (SSDI).”

Andy paused to see if Mike had any questions, then continued, “The good news for you is that MA covers many adults who are not determined disabled, including almost anybody whose family income is below 138% of the Federal Poverty Guidelines (FPG). And $15,000 a year is below the income limit for a one-person household, like yours, which is why you qualify. So, even though you do not have an official disability determination, you’ll qualify for free medical coverage that will be a big help with your disability-related medical needs.”

| Your family size: | |

Income limits for your family: | |

| $15,650 | |

| $5,500 | |

| $15,650 | |

| $5,500 | |

| $15,060 | |

| $5,380 | |

| Income-based MA, adults (138% FPG) | |

| Income-based MA, children/pregnant women (280% FPG) | |

| MinnesotaCare (200% FPG) | |

| Subsidized private plans, reduced fees (250% FPG) | |

| Subsidized private plans (no income limit) | -- |

If your family's income is at or below the limit for a program, you may qualify if you meet other program rules.

Notes:

| |

“Thanks for the information. How can I sign up?” asked Mike.

“Just go to MNsure,” said Andy. “It’s easy to apply there and you’ll get an immediate answer as to whether you qualify. Remember that if your income goes up in the future, you need to update your info on MNsure, so that you can keep getting the right type of health coverage for your situation.”

Mike went ahead and completed an application on MNsure and just as Andy had said, he was approved for MA. Mike was very happy that he’d be getting free health coverage and could focus his mental energies on establishing himself as a freelance writer instead of worrying about how to pay his medical bills.

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Mike Adapts to a Health Condition

Try It

Mike’s Income Goes Up

At first, Mike found that working for himself was hard. He had trouble getting freelance writing jobs and staying motivated to look for work. Eventually, he took some jobs doing boring technical writing, which helped cover his bills during his first year as a freelance writer. His guess about his income had been pretty spot on: he ended up making just a bit over $15,000 that year.

As time went on, though, he started making some baseball writing connections. Back in the old days, hustling up a job meant running around from office to office or ballpark to ballpark. But now Mike made his connections online by participating in baseball blogs, using his free time to write about stuff he really liked. During baseball season, Mike was able to watch multiple games on TV each day and he wrote about them for free on a small blog. Sometimes he just commented on the articles other people had written, often impressing the authors with his quick wit and cogent analysis.

By mid-season, he was becoming pretty well known on all of the Minnesota Twins blog sites and his opportunity came up: one of the major blog writers was going on a maternity leave and they needed a substitute writer for the rest of the season. Mike submitted a sample article and was given a shot at a weekly column.

This was way more exciting than covering high school lacrosse, and he dedicated his full energies to his writing, producing better output than he ever had. Things went great, and by the time the season was over, he had become a real part of the local baseball writing scene. He didn’t want to have a full-time job at a single spot, though, because he wanted to be in control of his schedule and be able to work from home as a way of dealing with his disability, which little by little was limiting his physical strength. Instead, he used his new connections to get a series of freelance writing gigs and by the time spring training had started up the following February, Mike had a steady income writing about professional baseball. He didn’t make quite as much money as he did back at the paper, but he liked his work way more and the roughly $3,000 per month he was making was pretty good as far as he was concerned. He even opened up an Individual Retirement Account (IRA) and started putting some money into it each month.

When his income started going up, he realized that he might not qualify for Medical Assistance (MA) anymore. He remembered that he was supposed to go back to MNsure and update his information anytime his situation changed. He was a little confused about how to do this, so he decided to call MNsure over the phone at 1-855-3-MNSURE (1-855-366-7873). They explained that he just had to log into the website and that when he updated his income information, MNsure would let him know about any changes to his insurance.

“If your income has gone up so much that you don’t qualify for MA anymore, MNsure will automatically notify you and help you enroll in an alternative. If your income were between 138% and 200% of the Federal Poverty Guidelines (FPG), you’d probably qualify for low-cost health coverage through MinnesotaCare. However, now that you’re making $3,000 a month, you are over 200% of FPG for a household with just one occupant, so you’ll instead have to sign up for an individual insurance plan from a private company.”

Mike thought about this and asked the MNsure phone representative if this meant he’d have to pay a lot for his insurance.

“Probably not,” explained the MNsure support person. “ I think you may qualify for tax subsidies for your individual insurance plan. That basically means that the government will help you pay the monthly premium if it’s too expensive. For example, if you get an average silver level plan, you’d only have to pay 8.5% of your income for the premium. If your plan has a higher premium, the government would pay the rest. So in your case, that means the most you’d pay for a plan would be $255 per month (8.5% of the $3,000 you make each month). You can get a more exact estimate of how much you might have to pay by using MNsure's Shop and Compare tool.”

This sounded like an affordable amount for Mike, now that he was making more money. He went ahead and updated his information on MNsure. When he did that, he got a message that because his income had gone up, he would no longer qualify for MA. Losing MA meant that he could sign up for a private insurance plan, even though it wasn’t the normal open enrollment period. He looked at the silver plans and some of them were actually cheaper than what he had been told over the phone. He considered them, but in the end decided to get a platinum level plan. A platinum level plan meant he’d have to pay a higher premium each month (more than $400 for the plan he chose), but with his multiple sclerosis, he wanted a plan that would have lower copayments and no deductible. Since he knew he’d need to see the doctor pretty often, the platinum plan would actually be cheaper for him in the end due to the lower out-of-pocket expenses.

There was one other thing Mike had learned about now that he was making more money with his self-employment: taxes. At first, Mike didn’t know much about filing self-employment taxes, so he asked another freelance baseball writer he met, Suzanne. She explained that as a self-employed person, Mike had to diligently pay his income and Social Security taxes.

“So how do I do that?” asked Mike.

Suzanne replied, “I don’t really know the details of it; I’ve got an accountant who handles it for me.” Suzanne then put Mike in contact with her accountant, Dana, who provided low-cost accounting services for people who were self-employed and had low to moderate income. He wasn’t very happy about having to pay taxes every 3 months, because when he worked at the paper, he only filed taxes once per year.

He mentioned this to Dana, who said, “Actually, when you worked at the newspaper, you were paying taxes all year, it’s just that it was automatic. Each time you got paid, some of your pay was sent to the government automatically. Your income taxes got sent to the Internal Revenue Service (IRS) and your Social Security and Medicare taxes were sent to the Social Security Administration (SSA). That’s why if you look at your old pay stubs, at the top you’ll see the full amount of your paycheck, which is called your gross income, while the actual direct deposits to your bank account were a fair amount smaller.”

Mike took a moment to think about this and then asked, “So what you’re saying is that when I worked for another company, every time I got paid, some of my money went to taxes. Now that I’m working for myself, I just have to pay those same taxes once every three months? What if I don’t want to pay those taxes until the end of the year?”

Dana explained that it was important to pay taxes on time to avoid problems with the IRS. She also pointed out that the Social Security and Medicare taxes were especially important, because each year he worked, he could get up to 4 Social Security work credits. “You have to keep getting Social Security work credits to collect Social Security Disability Insurance (SSDI) and get Medicare health coverage if your disability ever gets worse and you can’t work anymore. You also need work credits to get Social Security benefits when you retire. And, the more you earn and pay in Social Security taxes, the bigger your Social Security checks will be when you get them. So, paying these taxes is really an investment in your future.”

“Wow,” said Mike. “That’s a really good point and it’s good to think about taxes that way. I’m really happy to know that the more I work and earn, the more support I’ll get from Social Security when I need it.”

After that, Mike continued his freelance work and gave Dana paperwork every 3 months about his income, so that his taxes could get filed correctly.

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Mike Adapts to a Health Condition

Try It

How Mike Did It

Mike was a journalist at a newspaper who discovered that he had a progressive disability, multiple sclerosis (MS). He adapted to his disability by leaving his job and becoming a freelance writer. When he did that, he lost his employer-sponsored health insurance, but was able to sign up for Medical Assistance (MA). During this process, he got support from many different people, including his former employer’s Human Resources department, a peer support group, benefits experts, and an accountant.

Mike took these steps to improve his situation:

- Got help from his employer’s Human Resources department so sign up for health insurance that paid for the medical care he got when he began feeling the effects of his disability

- Joined a support group for people with MS

- Decided to become self-employed

- Used DB101’s Finding the Right Coverage for You guide and learned that he probably qualified for MA

- Used DB101’s Chat with a Hub expert feature to get help from a real person over the phone to make sure he understood his options correctly

- Signed up for MA on MNsure

- Networked with others in his field to find more freelance work and boost his income

- Started putting money away for retirement in an Individual Retirement Account (IRA)

- Contacted MNsure at 1-855-3-MNSURE (1-855-366-7873) and then updated his information on the MNsure website

- Got help from an accountant to make sure that all self-employment income taxes and Social Security taxes were paid on time

With his freelance work, Mike had the freedom to work at the pace he wanted and as time went on, he achieved success in his field. He had health coverage and also felt secure knowing that by paying his Social Security taxes, he’d be covered by Social Security Disability Insurance (SSDI) if his disability got worse.

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.

Mike Adapts to a Health Condition

Try It

Next Steps

Learn More

To get information about any disability-related program, Chat with a Hub expert.

Learn more about Medical Assistance (MA):

- In DB101’s MA article

- At your local county or tribal human services office

- On the Minnesota Department of Human Services (DHS) website

Learn more about buying individual health coverage:

- In DB101’s Buying Health Coverage on MNsure article

- On MNsure. You can also call MNsure at 1-855-3-MNSURE (1-855-366-7873).

- By getting local help from MNsure Assisters.

Learn more about Social Security Disability Insurance (SSDI):

- In DB101’s Social Security Disability Insurance (SSDI) article

- On the Social Security Administration’s website

- At your local Social Security office

Learn more about self-employment taxes:

- At the Internal Revenue Service (IRS) Self-Employed Individuals Tax Center

- By watching an 8-lesson video series about small business taxes

- By connecting to a free tax preparation site

- By visiting Prepare + Prosper

Learn About Work and Benefits - Chat with a Hub expert!

When you have questions or need help, use Chat with a Hub expert. This feature connects you to a DB101 Expert using live chat, phone, or secure email. Anything you talk about is private.

- Understand your current benefits

- Get help using DB101.org

- Connect to resources

- Plan next steps

Free Legal Help

The Minnesota Disability Law Center (MDLC) provides free assistance to people with civil legal issues related to their disability. Call the MDLC Intake Line at 1-612-334-5970 (Twin Cities metro area), 1-800-292-4150 (Greater Minnesota), or 1-612-332-4668 (TTY).

The Minnesota Disability Law Center (MDLC) provides free assistance to people with civil legal issues related to their disability. Call the MDLC Intake Line at 1-612-334-5970 (Twin Cities metro area), 1-800-292-4150 (Greater Minnesota), or 1-612-332-4668 (TTY).

Find Local Services

|

You can use Minnesota Aging and Disability Resources to find social services near you, from benefits applications to job counseling. |

|

Try these searches:

Learn more

Progressive Disability

Resources, benefits, and laws can help you if you have a progressive disability.

Job Supports and Accommodations

Learn about reasonable accommodations and programs that help make work possible.

Buying Health Coverage on MNsure

You can get private health coverage through MNsure. The government may help you pay for it.